Capital Budgeting: The Capital Budgeting Process At Work

By Sham Gad

This tutorial will conclude with some basic, yet

illustrative examples of the capital budgeting process at work.

Example 1: Payback Period

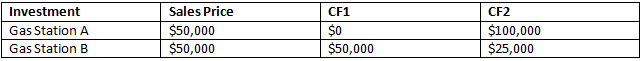

Assume that two gas stations are for sale with the following cash flows:

Example 1: Payback Period

Assume that two gas stations are for sale with the following cash flows:

|

According to the payback period, when given the

choice between two mutually exclusive projects, Gas Station B should be

selected. Although both gas stations cost the same, Gas Station B has a payback

period of one year, whereas Gas Station A will payback in roughly one and half

years. Payback analysis is common to everyone in investment decisions, an

example being the purchase of a hybrid car.

Example 2: Net Present Value Method

As was mentioned earlier, the payback period is a

very basic capital budgeting decision tool that ignores the timing of cash

flows. Since most capital investment projects have a life span of many years, a

shorter payback period may not necessarily be the best project.

NPVgas station A = $100,000/(1+.10)2 -

$50,000 = $32,644

|

NPVgas station B = $50,000/(1+.10) + $25,000/(1+.10)2 -

$50,000 = $16,115

|

In our gas station example, the net present value tool illustrates the limitations of the payback period. Under the payback period, the decision would have been to pick gas station B because it had the shorter payback period. Under the NPV criteria, however, the decision favors gas station A, as it has the higher net present value. In this particular case, the NPV of gas station A is more than twice that of gas station B, which implies that gas station A is a vastly better investment project to undertake.

In the real world, however, sometimes managers will make decisions that don't necessarily agree with the decision rules of the payback period, NPV or IRR methods. For example, suppose the NPV of gas station A was only slightly higher than that of B, yet the buyer was worried about meeting his financial obligations in year one. In that case, the choice may be made to take on the project with the quicker upfront cash flows even it means a slightly lower return. When might something like this occur? It could be that the buyer had to borrow a majority of the purchase price and really had a desire to pay back the loan sooner, rather than later, to save on interest expense. In that case, a quicker payback period may be more desirable than a slightly higher net present value project.

Do keep in mind, however, that all capital projects, in the case of for-profit enterprises, should be made in the context of creating long-term shareholder value. In our above example, gas station A with the higher NPV creates significantly more shareholder value than does gas station B. So even if the decision was made based on a quicker payback period, the project with greatest net present value would be the one that maximizes shareholder value. Generally speaking, accepting the project with the lower net present value would be destroying shareholder value.

Example 3 – Internal Rate of Return

The internal rate of return (IRR) method can

perhaps be the more complicated and subjective of the three capital budgeting

decision tools. Similar to the NPV, the IRR accounts for the time value of money. It

is useful here to repeat the definition of the IRR:

The IRR of any project is the rate of return that sets the NPV of a project zero.

Since the general NPV rule is to only pick projects with an NPV greater than zero with the highest net present value, the internal rate of return, by definition, is the breakeven interest rate. In other words, the IRR decision criteria conceptually obvious:

Choose projects with an IRR that is greater than the cost of financing

This rule is easy to understand: if your cost of capital is 10%, projects with an internal rate of return of 8% would destroy value, while projects with an internal rate of return of 15% with increase value.

While it's conceptually simple to understand the internal rate of return process, calculating IRR can be a bit tricky. The calculation of a project's IRR is essentially a trial and error one. Consider the following example of a project with the following cash flows:

There is no simple formula to calculate the IRR.

It's either done by trial and error or a financial calculator. Remember,

however, that the IRR is that rate where NPV is equal to zero, the equation

would be set up like this:

CF0 + CF1/(1+IRR) + CF2/(1+IRR)2 +

CF3/(1+IRR)3 = 0, or

|

-$1,000+ $100/(1+IRR) + $600/(1+IRR)2 + $800/(1+IRR)3 =

0

|

Believe or not, from here the next step is to guess a number for IRR, plug in and see if it equals zero.

When IRR = 20%, or .20, the result is a number greater than zero (you can try it yourself, just enter "0.20" in place of "IRR." Performing a trial and error calculation here would be too cumbersome but it's very simple and good practice, to try it yourself).

Thus 20% is too big a number. The next step would be to try a lower number.

When IRR = 17%, the NPV is less than zero, so that IRR is too low.

The IRR of this particular project is 18.1%. That is the interest where the NPV of the above project is zero. Plug it in and you should get zero or an insignificantly lower number that equates to zero.

Thus, if the cost of financing the above the project is below 18.1%, the project creates value under the IRR calculation; if the cost of financing is greater than 18.1%, the project will destroy value.

Just as is the case with the payback method and NPV, the IRR decision will not always agree with the NPV decision in mutually-exclusive projects. Again, this has to do with initial cash flow outlay and timing of future cash flows. However, in the end, despite the its flaws, percentages are more intuitive and useful in business, thus rendering value to the IRR method.

Read more: Capital Budgeting: The Capital Budgeting Process At Work https://www.investopedia.com/university/capital-budgeting/process-at-work.asp#ixzz5GNhDWQf9

Follow us: Investopedia on Facebook

No comments:

Post a Comment