Tuesday 30 January 2018

Thursday 25 January 2018

Depreciation – Part 3

Again….

There are two popular methods in calculating depreciation;

- Straight line method

- Reducing balance method

Straight line method

As stated by its name, straight line refers to the recurring figure over and over the year throughout its useful life. Of course the asset has its useful life as stated in my posting previously. For example;

A machine costing RM80,000 acquired in 2016. The useful life of the machine is 5 years. Then, the depreciation calculation is to get the cost of the machine and divided by the total number of years expected (useful life).

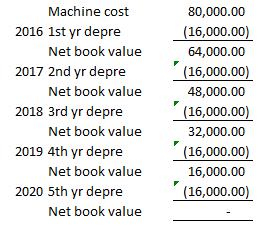

The calculation would be RM80,000/5 years = RM16,000 per year. This RM16,000 is the annual depreciation charged to the Profit and Loss Account in the expenses section for the next 5 years. Clear example will be as below;

See! every year will be the same depreciation figure. That is why we called this a straight line method.

Now, for another example,

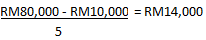

A machine cost RM80,000 acquired in 2016. The expected useful life of the machine is 5 years and at the end of year 5, the machine is expected to have a secondhand value of RM10,000. Then the depreciation calculation will be as follow,

Since the depreciation charged is RM14,000 every year, then it is a straight line method. Because the same figure keeps recurring every year.

Since the depreciation charged is RM14,000 every year, then it is a straight line method. Because the same figure keeps recurring every year.

Another example…

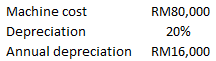

A machine cost RM80,000 acquired in 2016. The depreciation is 20% per annum using straight line method. Here, the question is clear, it states the depreciation method. So the depreciation calculation will be much simpler.

Last one, many huh!

A machine cost RM80,000 acquired in 2016. The depreciation is 20% at cost. It doesn’t state the depreciation method as well as useful life. The question is silent. Logically, if the depreciation is at cost, then the calculation should always refer to the cost. Just follow the same calculation as above.

Ok see you later!

Junior Apprentice – Section 1 – USR2004

Assalamualaikum and dear students,

Tomorrow, as usual we will have our class for JA. Please make sure that your report is ready and I also want to collect your Jumbo Sales contribution.

So…see ya!

Wednesday 24 January 2018

Depreciation – Part 2

There are also other reasons for depreciation and that are

- Obsolescence

- Wear and tear

- Perishability

- Usage right

- Natural causes

Obsolescence

It comes from the word obsolete. Do you know what is typewriter. If you don’t know, I suggest you can browse the net and take a look at the thing. Years ago, people use that to type letters etc. And now, people seldom use that unless you have a power failure or a times of emergency. It is now being replaced by the computer. We can say that the typewriter is now obsolete and may cause inefficiency.

Wear and tear

Things will be old. Humans also growing old and older by the day. Like I was saying previously, you purchased a mobile phone and the usage of the mobile phone will eventually makes the phone looks old. Even when you have a new car today, what will your car looks in the next 5 years? Clothes…the colour will gradually changed and end up as a cloth for wiping tables!

Perishability

Some asset has a very short life span. Mostly applicable to inventory. Did you notice that there is an expiry date on the bottle of milk you purchase from the convenient store or a loaf of bread, there must be an expiry date. That time limit is also the sign of depreciation. Of course the milk is still fresh within the period and still safe to drink until the last date. But do you want to drink a milk that will expire tomorrow.? I don’t think so…

Usage right

The usage right is quite similar to the above concept. We take a software for example. Sometimes you purchase a program at a very high cost but the usage is only for a couple of years. So the software will be self terminated at due time. For instance, like any other antivirus software…it lasts only one year. then it will continue to updating new database as you extended or purchased new license.

Natural causes

Erosion, rust, rot and decay, that are some of the natural causes that cause the depreciation. Land facing erosion, steel rust, wood will rot and teeth will decay. We cannot stop that because its natural. So everything depreciates.

Tuesday 23 January 2018

Depreciation – Part 1

Why depreciate?

As you all know, it is because of time. Will you be young forever? I don’t think so unless you are immortal. Humans ageing every minute of their life. Same goes to non-living things. They grew older and older through time.

So…Assets. We have current and non-current assets. The one that we will focus on is the non-current assets. This is because the business use these assets to generate income and in their operations. Still remember what are the things in the non-current assets? They are land and building, pant and machinery, fixtures and fittings, motor vehicles and office equipment. All these things the business use to generate income, which they owned, possess and control.

Simple example for depreciation, let say, you bought a mobile phone last January 2017 for RM3,000 and then you want to sell it to your friend in December 2017. How much you think you can sell it? Can you sell it for RM3,000 same as you purchased the mobile phone a year ago? Well, if you succeed to sell it for the same price you bought it at RM3,000, congratulations! Maybe that person either crazy or want to win your heart or maybe that person is on drugs! If you ask me, how much would I take it, of course, I would happy to purchase it from you for RM800-RM1,000.

Why?

Because the phone is considered a second hand item. It is already being used. Probably it might fell down from a cliff or something and not to mention, the owner of the phone always bring the phone to the toilet for whatever reasons…

The difference between the original price (cost price) and the current value is what we called depreciation. Original cost is RM3,000, the secondhand value is RM1,000. The difference is RM2,000 is depreciation. That is the cost of using the asset.

That is the simplest explanation for depreciation.

So tune in for the next episode. Later! Chiow!

Friday 19 January 2018

Group Assignment – Financial Accounting II – BUS2231

THE HANG AFFAIR

Assalamualaikum and dear guys and gals.

Finally, the wait is over. The assignment that you all have been wanting for so long has now arrived. You may download them and work in a group of 3-4 person per group. The dateline for the assignment submission is on 5th March 2018 at 1500hrs. Any late submission will not be entertained.

Good luck!

SOCI and SOFP exercise for DOM2234 and CBA1133

Here is an exercise for you to do SOCI and SOFP. Practice makes perfect!

| TryMyBest | ||

| Trial Balance | ||

| As at 31 December 2018 | ||

| Dr | Cr | |

| Sales and Purchases | 1,680,300 | 4,520,000 |

| Returns | 16,300 | 12,740 |

| Land and building | 1,420,000 | |

| Machinery | 140,000 | |

| Motor vehicle | 260,000 | |

| Office equipment | 26,000 | |

| Opening inventory | 49,260 | |

| Cash at bank | 125,700 | |

| Cash in hand | 14,290 | |

| Receivables and Payables | 343,800 | 89,300 |

| Accruals and Prepayment | 27,730 | 14,100 |

| Sundry debtorr and creditors | 1,550 | 600 |

| Term loan | 120,000 | |

| Rental | 120,000 | 18,000 |

| Salary and wages | 180,000 | |

| Electricity and water | 21,340 | |

| Printing and stationeries | 1,820 | |

| Transportation charges | 14,400 | |

| Interest | 6,560 | 340 |

| Commission | 12,000 | 2,000 |

| Discounts | 18,400 | 4,600 |

| Entertainment | 17,100 | |

| Advertisement | 31,600 | |

| Telephone and internet | 9,080 | |

| Insurance | 10,300 | |

| Bad Debt | 37,550 | |

| Maintenance – building | 153,000 | |

| Mainenance – Motor vehicle | 19,400 | |

| Maintenance – machinery | 9,700 | |

| Drawings | 14,500 | |

| 4,781,680 | 4,781,680 | |

| Closing inventory as at 31 December 2018 is RM52,360 | – | |

or else you can download it here TryMyBest - Final Accounts

Thursday 18 January 2018

Junior Apprentice – Section1 – USR2004

Assalamualaikum and dear students,

There will be no class tomorrow (19th January 2018) as all of you are tired after giving all your best during our Jumbo Sales. Congratulations and thank you for the commitment and may all the hardwork you have put be rewarded by Allah swt. All are done for a charity.

So, just relax and prepare for the report submission.

Adioss

Tuesday 16 January 2018

Junior Apprentice – USR2004 – Section 1

re you ready for tomorrow. Just make sure everything is ready as I will go around and check. OK?

See you tomorrow!

Certified Healthcare Facility Manager – Medivest – Batch 2 – Final Assessment

ear friends,

Here are some tips regarding your final assessment. There will be 2 sections.

Section A : 10 questions (20 marks)

Areas covered: Classification of assets, liabilities and equity. Equity calculation. Types of costs.Inventory evaluation. Break-even point. Tax and income tax. Audit. Financial management and ratios.

Section B : 5 questions (Answer 3 only)

Q1 – Financial Accounting (20m)

You need to know about equity calculation. Accounting information and depreciation .

Q2 – Management Accounting (20m)

Read about Break-even point, EOQ and something about the management accounting itself.

Q3 – Financial Management (20m)

Ratio analysis, time value of money and some investment calculation.

Q4 – Taxation (20m)

Resident status, badges of trade and Malaysia tax system.

Q5 – Auditing (20m)

Type s of audit, the internal and external auditor and also audit situation.

So good luck! Hope to see you at 10am.

Go Medivest!

Wednesday 10 January 2018

Junior Apprentice – Section 1 – USR2004

Assalamualaikum guys and gals,

There will no Usrah class for this coming Friday 12th January 2018 as all of you will be heading for your short mid-semester break. Just prepare the necessary for the coming Jumbo Sales, ok?

Tuesday 9 January 2018

Adab belajar

ADAB DENGAN GURU

===================

===================

Tak datang kelas atas sebab yang tak munasabah pun salah satu perkara yang menunjukkan kurangnya adab terhadap guru. Bagaimana mungkin guru boleh datang ke kelas semata-mata untuk mengajar kita tapi kita tak datang dengan alasan : “Alaa silibus dah habis, sekarang ni revision je, baik aku study kat rumah”. Nampak di situ, dia boleh buat tak layan guru tu datang ke kelas untuk mengajar dia.

“Sesiapa yang ingin dibukakan hatinya oleh Allah, maka hendaklah dia berkhalwah, sedikit makan, menjauhi daripada bergaul dengan orang yang bodoh, dan membenci orang yang tidak berlaku adil dan tidak beradab daripada kalangan mereka yang berilmu.” (Kitab Majmuk, Syarah Mazhab Jilid 1)

Ada seorang ulama ni, dia belajar banyak tapi ilmu tu tak masuk2 tapi dia sangat jaga adab dia dengan gurunya. Satu ketika, gurunya tiada dan gurunya menyuruh ulama ni menggantikan tempatnya. Ulama ni pun risau, dia langsung tak tau apa-apa. Jadi dia pun bertawakkal dan tiba2 dia dapat mengajar ilmu itu sepertimana yang gurunya ajarkan kepadanya.

Hilangnya keberkatan ilmu ataupun hilangnya kesan ilmu adalah kerana tidak menjaga adab daripada ilmu. Ada orang boleh menghafal semua kitab, boleh menghafal semua ilmu tetapi kemungkinan kesan daripada ilmu tadi tiada dalam hidup dia ataupun ilmu tadi tak boleh nak datangkan kemanfaatan pada dirinya, mungkin kerana hilangnya adab.

Ulama terdahulu mempelajari adab sebelum mempelajari ilmu. Mereka menjaga adab walau sekecil-kecil adab.

“Aku membelek kertas di hadapan Imam Malik perlahan-lahan kerana menghormatinya supaya dia tidak terdengar (bunyi belekan kertas tersebut)”

“تعلّمت الأدب عشرين سنة وتعلّمت العلم عشرة سنة”

“Aku mempelajari adab menuntut ilmu selama 20 tahun dan mempelajari ilmu selama 10 tahun”

(Kitab Ta’limul Muta’allim)

(Kitab Ta’limul Muta’allim)

Subscribe to:

Posts (Atom)