Assalamualaikum guys,

Attached are some questions for your guys to attempt. It is not the final question but it is better be ready.

Click here...

AMA exercise

Thursday, 31 May 2018

Wednesday, 30 May 2018

ACC2233 - Short Quiz

Assalamualaikum and dear students,

This is our final round of quiz. Marks will be given to the fastest all correct answers. Snap your answer and yippi me ASAP.

Relax, marks will also be given to those who are late but will rated according to the time ranking.

Happy finals!

This is our final round of quiz. Marks will be given to the fastest all correct answers. Snap your answer and yippi me ASAP.

Relax, marks will also be given to those who are late but will rated according to the time ranking.

Happy finals!

Short Quiz

1. A

machine costing RM12,000 was sold to a client on hire purchase term in January 2016. The cash price of the machine

was RM16,000. The interest rate was fixed to be 8% per annum which is payable

on 31 December each year. The depreciation rate for the machine is 20% per

annum at cost. Instalment payment was agreed for RM3,200 plus interest charged during the year.

Required: (in

the book of purchaser)

a) Asset

account

b)

Hire purchase creditor account

c) Provision

for depreciation account

2. The

above machine was confiscated in March 2019 due to failure of instalments

payment. The supplier took the machine with zero compensation.

Required : (in the book of purchaser)

a) Asset

disposal account

3. Independent

from the above question, assuming the machine instalment was fixed at RM3,772

per annum for 5 years, then…

Required: (in

the book of seller)

a) Hire

purchase seller account

b)

Hire purchase debtor account

c) Hire

purchase interest account

4. Haslita

acquired a vacant factory at a cost of RM620,000. During the process, she has

to pay for the stamp duty worth RM1,200, legal fees to Tetuan Khatijah & Co

for RM10,500, a bribe to a Minister RM50,000. She also has to build a new fence

around the factory to safeguard her trucks amounting RM13,000.

Required:

Calculate the initial cost for the above to be recognized

in the Statement of Financial Position at the end of the year.

Calculate the

following using the FIFO and Weighted Average method;

Date

|

Transactions

|

Mar 1

|

Purchased 70 units at RM15

each

|

3

|

Sold 25 units at RM22 each

|

4

|

Purchased 20 units at RM16

each

|

6

|

Sold 40 units at RM23 each

|

9

|

Sold 20 units at RM24 each

|

12

|

Purchased 30 units at

RM15.50 each

|

13

|

Sold 15 units at RM22 each

|

MFRS 110 - Event After Reporting Period

Group assignment

MFRS110 Event After the Reporting Period

NurKhairunisa Husna binti Kamal Bahari

Nur Khatijah Binti Abdul Rahim

Nurhazar binti Barkath Ali

MFRS110 Event After the Reporting Period

NurKhairunisa Husna binti Kamal Bahari

Nur Khatijah Binti Abdul Rahim

Nurhazar binti Barkath Ali

Tuesday, 29 May 2018

MFRS 116 - Property, Plant and Equipment

Group assignment

MFRS116 Property, Plant and Equipment

Fara binti Mohamad Yusof

Nurul Syaqinah binti Yacop

Muhammad Nabil bin Hisyamuddin

Muhammad Irman bin Zulkifli

MFRS116 Property, Plant and Equipment

Fara binti Mohamad Yusof

Nurul Syaqinah binti Yacop

Muhammad Nabil bin Hisyamuddin

Muhammad Irman bin Zulkifli

MFRS 138 - Intangible Assets

Group assignment

MFRS138 Intangible Assets

Nur Farisha Ruzini binti Mohd Zin

Nurul Azzyyati binti Mohd Kamarudin

Amirah Izzaty binti Mohiddin

Norfatihah binti Rasuli

MFRS138 Intangible Assets

Nur Farisha Ruzini binti Mohd Zin

Nurul Azzyyati binti Mohd Kamarudin

Amirah Izzaty binti Mohiddin

Norfatihah binti Rasuli

Thursday, 24 May 2018

Hire Purchase Accounting - Exercise

Assalamualaikum and dear students,

Let's do this...

Cash price RM5,000

Hire purchase rate 10%

Instalments amount RM1,319 (payable on 31 December each year)

No of instalments 5

Cost of the machine RM3,900

Required:

a) Hire purchase sales

b) Hire purchase debtor

c) Hire purchase interest

d) Cost of hire purchase goods

e) Cash book

f) Trading account (extract) for year 2016 - 2020

Let's do this...

Exercise - Hire

Purchase

The machine was sold on 1 January 2016 to Izzaty on hire

purchase terms. Below are the details of the transactions;

Cash price RM5,000

Hire purchase rate 10%

Instalments amount RM1,319 (payable on 31 December each year)

No of instalments 5

Cost of the machine RM3,900

Required:

a) Hire purchase sales

b) Hire purchase debtor

c) Hire purchase interest

d) Cost of hire purchase goods

e) Cash book

f) Trading account (extract) for year 2016 - 2020

MFRS101 - Financial Statement Exercise - Mashitah Berhad

Assalamualaikum guys and gals,

As promised, below is the MFRS101 Presentation of Financial Statement exercise. Attempt this and use it as your practice towards your final exam.

MFRS101 - Mashitah Enterprise

As promised, below is the MFRS101 Presentation of Financial Statement exercise. Attempt this and use it as your practice towards your final exam.

MFRS101 - Mashitah Enterprise

Investment Appraisal/Capital Budgeting

Guys, sorry for the previous posting. The notes appeared a little bit wide (not a little bit...huge!) due from the unprofessional cut and paste technique.

Ok, we still proceed on the subject as you are now busy with your assignments. Below, I patched in some videos for you to look into for your self study. It is taken from the ACCA F2 paper.

Ok, we still proceed on the subject as you are now busy with your assignments. Below, I patched in some videos for you to look into for your self study. It is taken from the ACCA F2 paper.

I will keep posting the relevant videos...

Capital Budgeting

Capital Budgeting: The Capital Budgeting Process At Work

By Sham Gad

This tutorial will conclude with some basic, yet

illustrative examples of the capital budgeting process at work.

Example 1: Payback Period

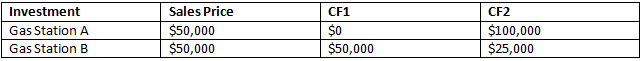

Assume that two gas stations are for sale with the following cash flows:

Example 1: Payback Period

Assume that two gas stations are for sale with the following cash flows:

|

According to the payback period, when given the

choice between two mutually exclusive projects, Gas Station B should be

selected. Although both gas stations cost the same, Gas Station B has a payback

period of one year, whereas Gas Station A will payback in roughly one and half

years. Payback analysis is common to everyone in investment decisions, an

example being the purchase of a hybrid car.

Example 2: Net Present Value Method

As was mentioned earlier, the payback period is a

very basic capital budgeting decision tool that ignores the timing of cash

flows. Since most capital investment projects have a life span of many years, a

shorter payback period may not necessarily be the best project.

NPVgas station A = $100,000/(1+.10)2 -

$50,000 = $32,644

|

NPVgas station B = $50,000/(1+.10) + $25,000/(1+.10)2 -

$50,000 = $16,115

|

In our gas station example, the net present value tool illustrates the limitations of the payback period. Under the payback period, the decision would have been to pick gas station B because it had the shorter payback period. Under the NPV criteria, however, the decision favors gas station A, as it has the higher net present value. In this particular case, the NPV of gas station A is more than twice that of gas station B, which implies that gas station A is a vastly better investment project to undertake.

In the real world, however, sometimes managers will make decisions that don't necessarily agree with the decision rules of the payback period, NPV or IRR methods. For example, suppose the NPV of gas station A was only slightly higher than that of B, yet the buyer was worried about meeting his financial obligations in year one. In that case, the choice may be made to take on the project with the quicker upfront cash flows even it means a slightly lower return. When might something like this occur? It could be that the buyer had to borrow a majority of the purchase price and really had a desire to pay back the loan sooner, rather than later, to save on interest expense. In that case, a quicker payback period may be more desirable than a slightly higher net present value project.

Do keep in mind, however, that all capital projects, in the case of for-profit enterprises, should be made in the context of creating long-term shareholder value. In our above example, gas station A with the higher NPV creates significantly more shareholder value than does gas station B. So even if the decision was made based on a quicker payback period, the project with greatest net present value would be the one that maximizes shareholder value. Generally speaking, accepting the project with the lower net present value would be destroying shareholder value.

Example 3 – Internal Rate of Return

The internal rate of return (IRR) method can

perhaps be the more complicated and subjective of the three capital budgeting

decision tools. Similar to the NPV, the IRR accounts for the time value of money. It

is useful here to repeat the definition of the IRR:

The IRR of any project is the rate of return that sets the NPV of a project zero.

Since the general NPV rule is to only pick projects with an NPV greater than zero with the highest net present value, the internal rate of return, by definition, is the breakeven interest rate. In other words, the IRR decision criteria conceptually obvious:

Choose projects with an IRR that is greater than the cost of financing

This rule is easy to understand: if your cost of capital is 10%, projects with an internal rate of return of 8% would destroy value, while projects with an internal rate of return of 15% with increase value.

While it's conceptually simple to understand the internal rate of return process, calculating IRR can be a bit tricky. The calculation of a project's IRR is essentially a trial and error one. Consider the following example of a project with the following cash flows:

There is no simple formula to calculate the IRR.

It's either done by trial and error or a financial calculator. Remember,

however, that the IRR is that rate where NPV is equal to zero, the equation

would be set up like this:

CF0 + CF1/(1+IRR) + CF2/(1+IRR)2 +

CF3/(1+IRR)3 = 0, or

|

-$1,000+ $100/(1+IRR) + $600/(1+IRR)2 + $800/(1+IRR)3 =

0

|

Believe or not, from here the next step is to guess a number for IRR, plug in and see if it equals zero.

When IRR = 20%, or .20, the result is a number greater than zero (you can try it yourself, just enter "0.20" in place of "IRR." Performing a trial and error calculation here would be too cumbersome but it's very simple and good practice, to try it yourself).

Thus 20% is too big a number. The next step would be to try a lower number.

When IRR = 17%, the NPV is less than zero, so that IRR is too low.

The IRR of this particular project is 18.1%. That is the interest where the NPV of the above project is zero. Plug it in and you should get zero or an insignificantly lower number that equates to zero.

Thus, if the cost of financing the above the project is below 18.1%, the project creates value under the IRR calculation; if the cost of financing is greater than 18.1%, the project will destroy value.

Just as is the case with the payback method and NPV, the IRR decision will not always agree with the NPV decision in mutually-exclusive projects. Again, this has to do with initial cash flow outlay and timing of future cash flows. However, in the end, despite the its flaws, percentages are more intuitive and useful in business, thus rendering value to the IRR method.

Read more: Capital Budgeting: The Capital Budgeting Process At Work https://www.investopedia.com/university/capital-budgeting/process-at-work.asp#ixzz5GNhDWQf9

Follow us: Investopedia on Facebook

Thursday, 17 May 2018

BUACC3714 - Make or Buy - Example

The following example illustrates the numerical part of a simple make-or-buy decision.

Example

The estimated costs of producing 6,000 units of a component are:

| Per Unit | Total | |

| Direct Material | $10 | $60,000 |

| Direct Labor | 8 | 48,000 |

| Applied Variable Factory Overhead | 9 | 54,000 |

| Applied Fixed Factory Overhead | 12 | 72,000 |

| $1.5 per direct labor dollar | ||

| $39 | $234,000 |

The same component can be purchased from market at a price of $29 per unit. If the component is purchased from market, 25% of the fixed factory overhead will be saved.

Should the component be purchased from the market?

Solution

| Per Unit | Total | |||

| Make | Buy | Make | Buy | |

| Purchase Price | $29 | $174,000 | ||

| Direct Material | $10 | $60,000 | ||

| Direct Labor | 8 | 48,000 | ||

| Variable Overhead | 9 | 54,000 | ||

| Relevant Fixed Overhead | 3 | 18,000 | ||

| Total Relevant Costs | $30 | $29 | $180,000 | $174,000 |

| Difference in Favor of Buying | $1 | $6,000 | ||

EXAMPLE

Here is a hypothetical example for coming to a make-or-buy decision. A reputable skateboard company is now manufacturing the heavy duty bearing that is utilized in its most liked line of skateboards. The business’ accounting section reports the following expenses for manufacturing 8000 units of the bearings internally every year.

| Direct Materials | $6 | x | 8000 | = | $48,000 |

| Direct Labor | $4 | x | 8000 | = | $32,000 |

| Supervisor Salary | $3 | x | 8000 | = | $24,000 |

| Variable Overhead | $1 | x | 8000 | = | $8,000 |

| Allocated general overhead | $5 | x | 8000 | = | $40,000 |

| Depreciation of special equipment | $2 | x | 8000 | = | $16,000 |

| Total Expense | $21 | x | 8000 | = | $168,000 |

An external supplier offered to sell 8000 bearings to the skateboard company for only $19 per bearing. Should the business cease manufacturing the bearings internally or instead, purchase them from an external supplier? To arrive at a make-or-buy decision, the focus should, at all times, be on the relevant costs (the ones that differ between the alternatives). The expenses that differ between alternatives comprise the expenses that could be prevented by buying the bearings from an external supplier.

If the expenses that can be avoided by buying bearings from the external supplier amount to less than $19, the business must continue to manufacture its bearings and reject the external supplier’s offer. On the other hand, if the expenses that can be prevented by buying the bearings from the external supplier amount to more than $19, the external supplier’s offer should be accepted.

You can use the setup below to manage your applicable/avoidable expenses.

Total applicable/avoidable expense for Making 8000 units:

| Direct Materials | $6 | x | 8000 | = | $48,000 |

| Direct Labor | $4 | x | 8000 | = | $32,000 |

| Supervisor Salary | $3 | x | 8000 | = | $24,000 |

| Variable Overhead | $1 | x | 8000 | = | $8,000 |

| Allocated general overhead | not | relevant | |||

| Depreciation of special equipment | not | relevant | |||

| Total Expense | $14 | x | 8000 | = | $112,000 |

Total expense for Buying 8000 Units:

| Outside purchase expense | $19 | x | 8000 | = | $152,000 |

The difference of $40,000 supports continuing to make 8000 units.

Keep in mind that depreciation of special equipment is mentioned as one of the expenses for manufacturing the bearings internally. Owing to the fact that the equipment has already been bought, this depreciation is a sunken expense and is, therefore, not applicable. If the equipment could be utilized to create another product, this may be a relevant expense as well. Still, we suppose that the equipment has no salvage value and no other use.

In addition, the company is setting aside a part of its general operating expenses, for bearings. Any part of the general operating expenses that would be done away with if the bearings were bought instead of made would be pertinent in this analysis. However, the general operating expenses are possibly a common expense to all the company’s goods produced in the factory and which would continue without changes even if the bearings were bought from outside (is not relevant).

The variable cost (direct labor, direct material and variable overhead) can be prevented if the business does not make the bearing. In addition, we suppose that the supervisor’s salary can also be avoided. This is because at $40,000, it costs less to manufacture the bearings internally than to purchase them from an external supplier.

In conclusion, it may be said, the make-or-buy decision is a very important decision with respect to overall production strategy and the possible implications for asset levels, employment levels and key competencies. Business accounting may appear to be an easy set of equations mirroring the money that enters into a business and that which flows out from it. However, in reality, there are countless intricacies associated with the relationship between various kinds of income and costs. Complexity is particularly obvious in make-or-buy. Considering these aspects, the make-or-buy decision should be weighed with utmost care.

BUACC3714 - Accept or Reject Special Order - Example

Example taken from http://www.accountingverse.com/managerial-accounting/relevant-costing/accept-or-reject.html

Example - With Excess Capacity

Example - With Excess Capacity

In a month, ABC Company normally produces and sells 8,000 units of its product for $20. Variable manufacturing cost per unit is $10. Total fixed manufacturing costs (up to the maximum capacity of 10,000 units) are $38,000. Variable operating cost is $1 per unit and fixed operating costs total $10,000.

A customer placed a special order for 1,500 units for $15 each. The customer is willing to shoulder the delivery costs; hence the business will not incur additional variable operating costs. Should the company accept or reject the special order?

Solution:

The company has 2,000 units excess capacity to fill up the special order of 1,500 units. The only costs to be considered in this case are the variable manufacturing costs. The total fixed cost is the same regardless of the level of activity. Even if an additional 1,500 units are to be produced, the total fixed cost remains the same. In addition, both parties agreed that the company will not incur in additional variable operating costs.

Should the company accept the offer? Yes. The selling price of $15 exceeds the variable manufacturing cost of $10. This will result in additional income of $7,500 (1,500 x $5).

Proof:

w/o Special Order

|

w/ Special Order

| ||

| Sales |

$160,000

|

$182,500

| |

| Less: Variable costs | |||

| Var. manufacturing |

80,000

|

95,000

| |

| Var. operating |

8,000

|

8,000

| |

| Contribution margin |

$72,000

|

$79,500

| |

| Less: Fixed costs | |||

| Fixed manufacturing |

38,000

|

38,000

| |

| Fixed operating |

10,000

|

10,000

| |

| Operating Income |

$24,000

|

$31,500

|

The $182,500 sales revenue includes 8,000 units sold at $20 and 1,500 units sold at $15 each. Additional variable operating costs is avoided as mentioned in the problem. Fixed costs remain constant regardless of the level of activity.

Example - Without Excess Capacity

Using the same information in the above scenario but this time, assume that the company normally manufactures and sells 9,000 units instead of 8,000. Should the company accept the special order?

Solution:

Since the company has excess capacity of 1,000 units only, it is not enough to fill up the special order of 1,500 units. Hence, a portion of the regular sales (500 units) must be sacrificed to fill up the entire special order. The lost contribution margin should be considered. Contribution margin is equal to sales (at $20) minus variable costs ($10 variable manufacturing plus $1 variable operating).

Lost contribution margin = ($20 - $11) x 500 units = $4,500

The lost contribution margin is allocated over the items sold through the special order.

Lost contribution margin per unit = $4,500 / 1,500 units = $3

This cost is an additional consideration in the decision. Should the company accept the offer? The answer is still yes since the selling price ($15) is higher than the cost ($13, i.e. variable manufacturing cost per unit of $10 plus lost CM per unit of $3). This will result in additional income of $3,000 (1,500 x $2).

Proof:

w/o Special Order

|

w/ Special Order

| ||

| Sales |

$180,000

|

$192,500

| |

| Less: Variable costs | |||

| Var. manufacturing |

90,000

|

100,000

| |

| Var. operating |

9,000

|

8,500

| |

| Contribution margin |

$81,000

|

$84,000

| |

| Less: Fixed costs | |||

| Fixed manufacturing |

38,000

|

38,000

| |

| Fixed operating |

10,000

|

10,000

| |

| Operating Income |

$33,000

|

$36,000

|

The $192,500 sales revenue includes regular sales of 8,500 units (sold at $20 each) and 1,500 specially ordered units (sold at $15). As mentioned in the problem, the company will incur the variable operating cost only for regular sales. Fixed costs remain the same.

Another example from another site

https://accountingexplained.com/managerial/relevant-costing/special-order-pricing

Example

A company is producing, on average, 10,000 units of product A per month despite having 30% more capacity. Costs per unit of product A are as follows:

| Direct Material | $8.00 |

| Direct Labor | 5.00 |

| Variable Factory Overhead | 2.00 |

| Variable Selling Expense | 0.50 |

| Fixed Factory Overhead | 3.00 |

| Fixed Office Expense | 2.00 |

| $20.50 |

The company received a special order of 2,000 units of product A at $17.00 per unit from a new customer. Should the company accept the special order, provided that the customer has agreed to pay the variable selling expenses in addition to the price of the product?

Solution

The increment cost per unit for the special order is calculated as:

| Direct Material | $8.00 |

| Direct Labor | 5.00 |

| Variable Factory Overhead | 2.00 |

| $15.00 |

Since the incremental cost per unit is less that the price offered in the special order, the company should accept it. Accepting special order will generate additional contribution of $2.00 unit and $4,000 in total.

Subscribe to:

Comments (Atom)