Return on investment or ROI measures how much money or profit is made on an investment as a percentage of the cost of the investment. ROI shows how effectively and efficiently investment dollars are being used to generate profits. Investors use ROI to determine how successful their investment is performing, but also in comparing their ROI with the performance of other investments.

Your ROI likely changes depending on what you are investing in and what you consider to be "favorable returns." For example, a company tracks the returns from a new marketing campaign differently than investors track returns in their investment portfolios.

However, it's safe to say that an investor cannot evaluate any investment's profitability, whether it's a stock, bond, rental property, collectible or option, without first understanding how to calculate return on investment (ROI).

The formula serves as the base from which all informed investment decisions are made, and although the calculation remains constant, there are unique variables that different types of investment bring to the equation. In this article, we'll cover the basics of ROI and some of the factors to consider when using it in your investment decisions.

How To Calculate ROI

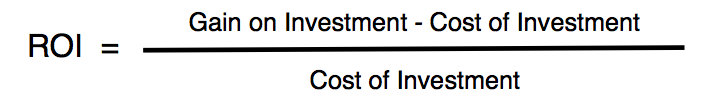

To calculate the profit on any investment, you would first take the total return on the investment and subtract the original cost of the investment. However, ROI is a profitability ratio meaning it gives us the profit on an investment represented in percentage terms. To calculate the percentage gain on an investment, we take the profit or net gain on the investment and divide it by the original cost as shown in the formula below:

Portfolio Example Of ROI

Suppose you bought 200 shares of Bank of America Corporation (BAC) on June 5th, 2017 at the price of $22.12 for a total cost of $4,424.00. Following your purchase, bank stocks soared due to a strong economy and interest rate hikes by The Federal Reserve, ultimately boosting bank earnings. As a result, you decided to sell your shares of BAC on April 2nd, 2018 at a price of $29.31 for a total return of $5,862 and a profit of $1,438 ($5,862-4,424).

Your ROI for BAC would be 33% ($1,438/4,424). In this case, you would have done very well for yourself.

To take a more extreme case, the price of Apple stock was just over $5 per share in 2005, when the first iPhone was still in development. Ten years later and the price of Apple stock has skyrocketed to over $125 per share, for an amazing ROI of 2,400%, or 240% per year.

For more examples of the ROI calculation, take a look at the How To Calculate ROI Video.

Comparing ROIs With Different Initial Investments

Simply comparing the dollar value of gains between two investments doesn't provide a complete picture of the return on each investment. Since ROI is a ratio expressed as a percentage, it provides clarity as to the true gain on an investment.

For example, Diane and Sean both told you they had made profits on their investments. Diane made $100 from investing in options while Sean made $5,000 investing in real estate. With only the total dollar value of their profits available, we might assume that Sean's investment gain was the better of the two. However, without understanding the costs of each investment, we can't make an accurate conclusion about their returns.

For example, if Sean's cost was $400,000 and Diane's was only $50, Sean's ROI would be 1.25% while Diane's would be 200%. Of course, a $5,000 gain is far more than a $50 gain, but Sean's initial cost was far more than Diane's and, as a result, Sean was at risk for greater losses. The cost of the investment both initial and ongoing, are an essential piece of information for any investment. To learn more about ROI and other ways to value investments; please read our Financial Ratio Tutorial.

ROI Can Be Misrepresented

The ROI calculation remains the same for every type of investment. The danger for investors comes in how costs and returns are accounted for. Here are some investments where their returns and subsequently their ROIs can be misrepresented.

Real estate can create returns in two ways, rental income and price appreciation. The investment return includes the rent collected and any price gains as the market value of the property rises. However, the costs of the investment come from many different sources including the initial purchase price, property taxes, insurance, and upkeep.

When we hear of people earning a 200% return from selling their home, they're often referring to the difference between the original purchase price and the selling price while omitting all of the costs over the years. For example, if it's an investment property, an investor might account for the rental income and price appreciation, but neglect to factor in the insurance costs, taxes and that new water heater.

Real estate can be a profitable investment, but the projected ROI on these investments can be exaggerated if all of the costs are not included. For more on real estate investing, please read How to Calculate ROI for Real Estate Investments.

Stocks

By not factoring in the transaction costs of investing in stocks, the ROI can become inflated. For example, let's say you made a $200 gain on a stock investment, but there was a $20 transaction fee charged when you bought the stock, and again when you sold it, your initial ROI of $200 would not be accurate.

Collectibles

Collectibles like a Honus Wagner baseball card, an Action Comics #1, or the 1933 Double Eagle can sell for millions, making for astronomical ROIs when compared to their original prices. However, collectibles are rarely purchased at their original prices and, depending on the type, have high insurance and maintenance costs that reduce their ROI.

Leveraged Investments

Leveraged investments allow initial investment dollars to be multiplied many times over boosting ROI by generating sizable returns. However, the incredible ROI from the investment must be tempered by the risks taken on by investing larger sums of money. Leveraging is a double-edged sword, meaning a one dollar outlay of cash becomes two or three dollars in investment magnifying any positive returns, but the losses are equally magnified.

However, there are some leveraged investments that cap losses. For example, with plain vanilla options, the most an investor could lose is the premium or initial price paid for the option. ROI doesn't tell the whole story when it comes to leveraged investments since the risk-reward tradeoff must also be considered.

ROI And The Length Of Time In An Investment

ROI measures the bottom line return of any investment. However, ROI doesn't factor in the length of time an investment position is held. For example, if stock investment A has an ROI of 100% and investment B an ROI of 50%, on the surface, the 100% gain is the clear winner. But, if investment A took 10 years to achieve its 100% return while investment B took only one month to earn its 50% gain, investment A's return wouldn't be as impressive. The length of time a position is held must come into play when calculating the true return on any investment. For more on how time can impact the return on an investment, please read up on the compound annual growth rate or CAGR.

The Bottom Line

ROI is useful for calculating the profit on an investment, but it's important to note that ROI is a historical measure, meaning it calculates past returns, and past returns don't guarantee future results. For example, a stock investment might yield an ROI of 200%-500% during its growth stage, but fall as the company matures. If you had invested in the stock following the growth stage, based on the historical ROI, your gain would not have matched the historical returns. Please be aware, projected ROIs on an unproven investment are even more uncertain with no data to back it up.

ROI can show how effectively your investment dollars are being used to generate profits. However, it's important to use ROI in conjunction with other financial ratios to give you a complete picture of an investment's potential.

No comments:

Post a Comment