Again….

There are two popular methods in calculating depreciation;

- Straight line method

- Reducing balance method

Straight line method

As stated by its name, straight line refers to the recurring figure over and over the year throughout its useful life. Of course the asset has its useful life as stated in my posting previously. For example;

A machine costing RM80,000 acquired in 2016. The useful life of the machine is 5 years. Then, the depreciation calculation is to get the cost of the machine and divided by the total number of years expected (useful life).

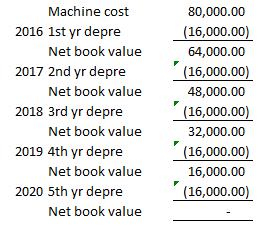

The calculation would be RM80,000/5 years = RM16,000 per year. This RM16,000 is the annual depreciation charged to the Profit and Loss Account in the expenses section for the next 5 years. Clear example will be as below;

See! every year will be the same depreciation figure. That is why we called this a straight line method.

Now, for another example,

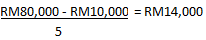

A machine cost RM80,000 acquired in 2016. The expected useful life of the machine is 5 years and at the end of year 5, the machine is expected to have a secondhand value of RM10,000. Then the depreciation calculation will be as follow,

Since the depreciation charged is RM14,000 every year, then it is a straight line method. Because the same figure keeps recurring every year.

Since the depreciation charged is RM14,000 every year, then it is a straight line method. Because the same figure keeps recurring every year.

Another example…

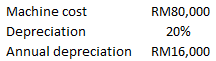

A machine cost RM80,000 acquired in 2016. The depreciation is 20% per annum using straight line method. Here, the question is clear, it states the depreciation method. So the depreciation calculation will be much simpler.

Last one, many huh!

A machine cost RM80,000 acquired in 2016. The depreciation is 20% at cost. It doesn’t state the depreciation method as well as useful life. The question is silent. Logically, if the depreciation is at cost, then the calculation should always refer to the cost. Just follow the same calculation as above.

Ok see you later!

No comments:

Post a Comment