A continuation from my recent post....

Trial balance is the LIST of balances of all the accounts that have been transacted in a period of time. After doing the balancing off of each account, the balance will be taken to form a statement called TRIAL BALANCE. This is normally done at the end of a period or whenever is need. Let say, your boss wanted a report to be presented tomorrow, and that tomorrow is not even the last day of the month! Should you tell your boss.."Hey look, I cannot accommodate your request since we are still in the middle of the month" Of course he will say, "Never mind, I'll get somebody to prepare it for me but you also need to prepare and pack up your things!" Hahahaha!

If that is the case, what you need to do is, just close the account, balancing it off and take the balances to post them at the trial balance. Look carefully at the balances either debit or credit. That will determine the location of the balances of the account. Or you need to know the nature of each account. If asset account, of course it is debit, liability is credit, equity is credit, revenue is credit and expenses is credit.

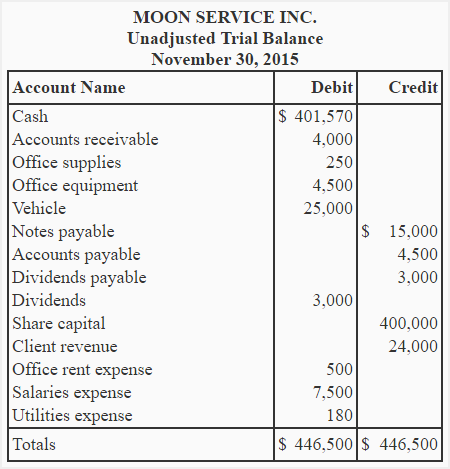

The example of a trial balance will be like this...

You need to get your trial balance BALANCE!. The name suggest it to be that way. If you managed to get it balance, then all your transactions of debits and credits are CORRECT!

No comments:

Post a Comment