What is the purpose of control accounts?

The purpose of the control account is to keep the general ledger free of details, yet have the correct balance for the financial statements. For example, the Accounts Receivable account in the general ledger could be a control account. If it were a control account, the company would merely update the account with a few amounts, such as total collections for the day, total sales on account for the day, total returns and allowances for the day, etc.

The details on each customer and each transaction would not be recorded in the Accounts Receivable control account in the general ledger. Rather, these details of the accounts receivable activity will be in the Accounts Receivable Subsidiary Ledger. This works well because the employees working with the general ledger probably do not need to see the details for every sale or every collection transaction. However, the sales manager and the credit manager will need to know detailed information on individual customers, including whether a customer recently reduced their account balance. The company can provide these individuals with access to the Accounts Receivable Subsidiary Ledger and can keep the general ledger free of a tremendous amount of detail.

Source: https://www.accountingcoach.com/blog/accounts-receivable-control-account-subsidiary-ledger

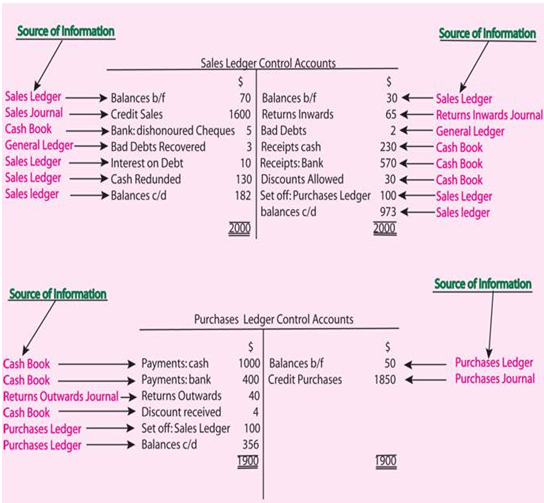

Sales Ledger Control Accounts And Purchases Ledger Control Accounts

Two of the most common Control Accounts are Sales Ledger Control Accounts and Purchases Ledger Control Accounts. After posting all transactions the balance of the Control Account and the sum of the detailed records in the Subsidiary Ledger should always be the same. In other words, a control account deals with summarized information while a subsidiary ledger deals with detailed information. Because the control accounts contain summarized information they are also called total accounts. Therefore a control account for a Sales Ledger can be called a Sales ledger Control accounts or Total Debtors Account. A control account for a Purchases Ledger can be called a Purchases Ledger Control account or a Total Creditors Account.

Sources of information for entries in Control Accounts

Significance of the balances on the control accounts

The closing balances on the sales ledger control accounts should be equal to the sum total of the closing balances on the individual debtor accounts in the sales ledger. It follow as well that the closing balances on the purchases ledger control accounts should be equal to the sum total of the closing balances on the individual creditor accounts in the purchases ledger. If the respective balances are not in agreement then it would suggest some form of irregularity in the records which would need investigation.

Source: http://wizznotes.com/accounts/control-systems/sales-ledger-control-accounts-and-purchases-ledger-control-accounts

No comments:

Post a Comment