I have a great experience today when I faced students who didn't have the heart to study. This is not the first time that I came across with this kind of attitude. I lost count.

Students nowadays don't have the urge to improve themselves. So many things have been done to attract them to like the subject and I think it is not my fault if the students don't like the subject. So here maybe are some of the reasons...

- They don't like to study.

- They don't like the subject.

- They don't like the lecturer.

- They don't like the class environment.

- They don't like their friends around them.

- They don't like the college.

- They don't like being handed exercises, quizzes or assignment.

- They don't like their parents.

- They don't like themselves.

In my opinion, I think the students choose No 9 which they don't like themselves. They hate being themselves. Why did I say that? It is because they don't care about themselves and they don't even care about their parents and worst maybe they don't even care what their religion asked them to be. Talk about respect, none exist!

If the students love themselves, taking care of ownself is sufficient. So what the students should do? For me just be positive. Positive people do positive things. Start with a simple du'a asking from Allah.

Rule of thumb for a student is to do whatever the lecturer/teacher ask them to do. Is that simple. If they don't want to follow instructions especially relating to their studies, then why must they call themselves as students? This is something that my mind can't compute not even digest.

Well, if I write this like 3 to 5 pages, or maybe 100 pages, still... just a waste of my time.... So that's it, see you guys later or see you when I see you or if I choose to see you. Adios Amigos!

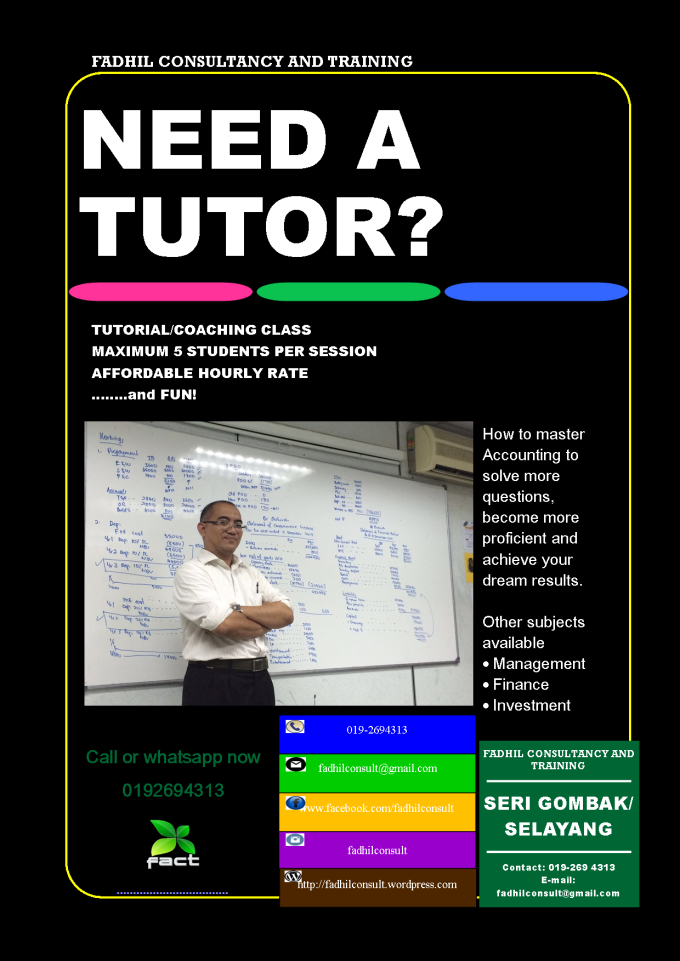

![IMG-20170828-WA0017[1]](https://fadhilconsult.files.wordpress.com/2017/08/img-20170828-wa00171.jpg)