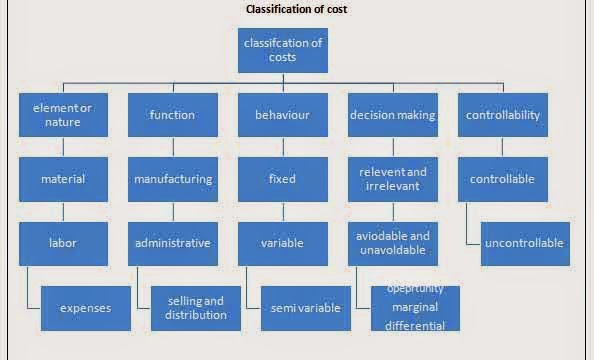

According to Wikipedia...Classification of cost means, the grouping of costs according to their common characteristics. ... Indirect costs are allocated or apportioned to cost objects. By Functions: production,administration, selling and distribution, R&D. By Behavior: fixed, variable, semi-variable.

RELEVANT AND IRRELEVANT COST (AccountingExplained)

The classification of costs between relevant costs and irrelevant costs is important in the context of managerial decision-making.

In any managerial decision involving two or more alternatives, the prime focus of analysis is to find out which alternative is more profitable. The profitability of alternatives is determined by considering the revenues generated by and costs incurred under each alternative. Some costs may stay the same regardless of which alternative is chosen while some costs may vary between the alternatives. The classification between relevant and irrelevant costs is useful in such situations.

Examples of situations in which the relevant vs irrelevant classification is useful include decisions regarding:- Shutting down a division of a business,

- Accepting an special order at lower price,

- Making a product in-house or purchasing it from outside,

- Selling a semi-finished product or processing it further, etc.

Relevant costs

Relevant costs are costs that are affected by a managerial decision in a particular business situation. In other words these are the costs which shall be incurred in one managerial alternative and avoided in another. As the name suggests they are ‘relevant’ for managerial analysis and should be considered in all calculations made for the purpose.

Irrelevant costs

Irrelevant costs are costs that are not affected by the ultimate decision. In other words, these are the costs which shall be incurred in the all managerial alternatives being considered. Since they are the same in all alternatives, they become irrelevant and need not be considered in calculations made for managerial analysis.

Try to do this!

Vital Industries is a company that manufactures personal care products. It has three divisions: hair care, skin care and dental care. Following is an extract from the financial statements for the year ending 31 December 2014:

| Hair Care | Skin Care | Dental Care | |||

| Revenue | $900 million | $600 million | $300 million | ||

| Net income/(loss) | $210 million | $100 million | ($50 million) |

In the board meeting summoned for review of financial statements, a director proposed that the company should dispose of the dental care division because it is loosing money. The CEO argued that the board can’t conclude that a segment is losing money just because it generated net loss for a period. He suggested that the company’s chief financial officer should conduct a detailed analysis for presentation in the next board meeting. Being the company’s management accountant, the CFO asked you to identify which of the following costs are relevant for the decision:

- CEO’s salary

- Salaries of Dental Care workers who can be laid-off

- Salaries of Dental Care workers who can’t be laid-off

- One-time retirement benefits to be paid to laid-off workers

- Cost of raw materials consumed by Dental Care division

- Annual directors’ fee

- Interest paid on loans raised for Dental Care division

- Salary of the Dental Care chief operating officer

- Company-wide quality certification fee

- License fee paid for the rights to manufacture dental care products

- Head office rent

- Audit fee (if it doesn’t depends on the number of divisions)

Potential marks ♥♥♥

Answer will be published on 27th July 2017 at 12 noon.

AVOIDABLE AND UNAVOIDABLE COST (my accounting course)

In a down economy, management is often faced with the decision of cutting branches, departments, and even products. In order to save the company money, managers tend to look the departments or products that are losing money or not turning a profit. A lot of times shutting down departments simply because they are losing money is not always a good idea. In fact, shutting down some non-profitable departments might even cost the company more money. Managers need to take a look at two main expenses when making a decision to close a department: avoidable costs and unavoidable costs.

Avoidable cost

Avoidable costs are costs that can be eliminated if a department is closed. Salaries are a good example of avoidable costs. When the branch closes, the salaries are stopped as well.

Unavoidable cost

Unavoidable expenses, on the other hand, are expenses that will not be eliminated if a department is closed. Unavoidable expenses are also called inescapable expenses for this very reason. A good example of an unavoidable expense is rent. Think if a business rents a 10,000 square foot building and uses it for three different departments or branches. Each department earns revenue and pays for a third of the rent expense. If one of the branches is closed, the company will still have to pay to rent the entire building. This rental expense isn't eliminated if the department is closed. In this case, the company might be better off keeping the non-profitable department open because it helps contribute one third of the rental expenses.

SUNK COST (accounting tools)

A sunk cost is a cost that an entity has incurred, and which it can no longer recover by any means. Sunk costs should not be considered when making the decision to continue investing in an ongoing project, since you cannot recover the cost. However, many managers continue investing in projects because of the sheer size of the amounts already invested in the past. They do not want to "lose the investment" by curtailing a project that is proving to not be profitable, so they continue pouring more cash into it. Rationally, they should consider earlier investments to be sunk costs, and therefore exclude them from consideration when deciding whether to continue with further investments.

An accounting issue that encourages this adverse behavior is that capitalized costs associated with a project must be written off to expense as soon as the decision is made to cancel the project. When the amount to be written off is quite large, this encourages managers to keep projects running.

Examples of Sunk Costs

Here are several examples of sunk costs:

- Marketing study. A company spends $50,000 on a marketing study to see if its new auburn widget will succeed in the marketplace. The study concludes that the widget will not be profitable. At this point, the $50,000 is a sunk cost. The company should not continue with further investments in the widget project, despite the size of the earlier investment.

- Research and development. A company invests $2,000,000 over several years to develop a left-handed smoke shifter. Once created, the market is indifferent, and buys no units. The $2,000,000 development cost is a sunk cost, and so should not be considered in any decision to continue or terminate the product.

- Training. A company spends $20,000 to train its sales staff in the use of new tablet computers, which they will use to take customer orders. The computers prove to be unreliable, and the sales manager wants to discontinue their use. The training is a sunk cost, and so should not be considered in any decision regarding the computers.

- Hiring bonus. A company pays a new recruit $10,000 to joint the organization. If the person proves to be unreliable, the $10,000 payment should be considered a sunk cost when deciding whether the individual's employment should be terminated.

OPPORTUNITY COST (BusinessDictionary)

A benefit, profit, or value of something that must be given up to acquire or achieve something else. Since every resource (land, money, time, etc.) can be put to alternative uses, every action, choice, or decision has an associated opportunity cost.

Opportunity costs are fundamental costs in economics, and are used in computing cost benefit analysis of a project. Such costs, however, are not recorded in the account books but are recognized in decision making by computing the cash outlays and their resulting profit or loss.

Example of opportunity costs;Opportunity costs are fundamental costs in economics, and are used in computing cost benefit analysis of a project. Such costs, however, are not recorded in the account books but are recognized in decision making by computing the cash outlays and their resulting profit or loss.

- The CEO of Ace Corporation considered the merger that the competing company offered him, but after examining the opportunity cost he decided that the sacrifices were too high and the benefits were too low to accept the deal.

- I would have gone to the movie since it cost less and the tickets were not refundable but I have to see this concert even if the opportunity cost doesn't make sense to most people.

- When deciding on whether or not to go back to college full-time, Jack included the opportunity cost of foregoing a stable paycheck in his decision.

Controllable Costs (accountingverse)

Controllable costs are costs that can be influenced or regulated by the manager or head responsible for it.

For example: direct materials, direct labor, and certain factory overhead costs are controlled by the production manager. Another example: the sales manager has control over the salary and commission of sales personnel.

Uncontrollable Costs

From the term itself, uncontrollable costs are those that are not under the control of a specified manager. These cannot be influenced by decisions or actions of the manager. These costs are imposed by the top management or allocated to several departments. For example, a company-wide advertising cost that is allocated by the central office to different departments is not under the control of the department heads.

Other examples include depreciation, insurance, share in rent, share in organization-wide security costs, etc.

Try to do this!

To effectively evaluate the performance of the production department of ABC Company, the management accountant wants to determine the controllable and uncontrollable costs from the following items:

- Direct materials

- Direct labor

- Factory overhead and other charges

- Indirect materials

- Indirect labor (supervision)

- Depreciation

- Insurance

- Allocated repairs and maintenance

- Allocated rent and utilities expense

Potential marks ♥♥♥

Answer will be published on 27th July 2017 at 12 noon.

COST BEHAVIOUR

Each cost has its own behaviour. Basically, there are 4 kinds of cost behaviour that we need to know and it relates to our daily life. We are making expenses but some of us may not know the cost classification and most of us making important decision based on wrong facts... FaCT!. See below

No comments:

Post a Comment