CVP formula with multi product

Previously, I have illustrated the BEP for a single product. This time around, I will show you how to calculate the BEP for a multi product company. A multi-product company means a company that sells two or more products.

The procedure of computing break-even point of a multi product company is a little more complicated than that of a single product company. Well, what to do.... this is what you agreed to study.....hahahaha!

It is late now....going to sleep. I took these from a web.

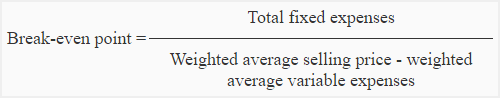

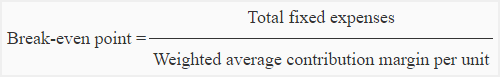

Formula:

A multi product company can compute its break-even point using the following formula:

For computing break-even point of a company with two or more products, we must know the sales percentage of individual products in the total sales mix. This information is used in computing weighted average selling price and weighted average variable expenses.

In the above formula, the weighted average selling price is worked out as follows:

(Sale price of product A × Sales percentage of product A) + (Sale price of product B × Sale percentage of product B) + (Sale price of product C × Sales percentage of product C) + …….

and the weighted average variable expenses are worked out as follows:

(Variable expenses of product A × Sales percentage of product A) + (Variable expenses of product B × Variable expenses of product B) + (Variable expenses of product C × Sales percentage of product C) + …….

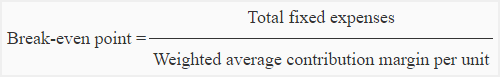

When weighted average variable expenses per unit are subtracted from the weighted average selling price per unit, we get weighted average contribution margin per unit. Therefore, the above formula can also be written as follows:

An example would be very helpful to understand the whole procedure. Consider the following example of a multi product company:

Example:

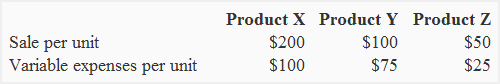

The Monster company manufactures three products – product X, product Y and product Z. The variable expenses and sales prices of all the products are given below:

The total fixed expenses of the company are $50,000 per month. For the coming moth. Monster expects the sale of three products in the following ratio:

Product X: 20%;

Product Y: 30%;

Product Z: 50%

Required: Compute the break-even point of Monster company in units and dollars for the coming month.

Solution:

Monster company sells three products and is, therefore, a multi product company. Its break-even point can be computed by applying the above formula:

= $50,000 / $95* – $55**= $50,000 / $40

= 1,250 units

*Weighted average selling price:

= ($200 × 20%) + ($100 × 30%) + ($50 × 50%)

= $40 + $30 + $25

= $95

**Weighted average variable expenses:

= ($100 × 20%) + ($75 × 30%) + ($25 × 50%)

= $20 + 22.50 + 12.50

= $55

The company will have to sell 1,250 units to break-even. Now I would compute the number of units of each product to be sold:

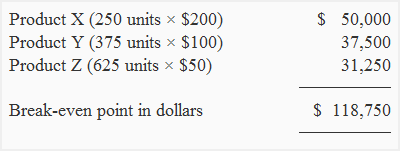

Product X (1,250 × 20%): 250 units

Product Y (1,250 × 30%): 375 units

Product Z (1,250 × 50%): 625 units

Total:250 units + 375 units + 625 units = 1,250 units

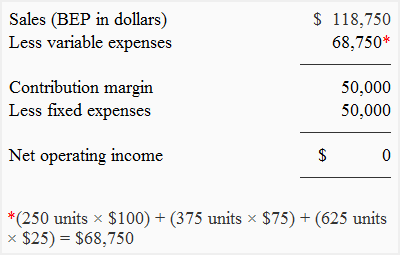

As the number of units of each individual product to be sold have been computed, I can compute the break even point in dollars as follows:

The break-even point of Monster company is $118,750. It can be verified by preparing a contribution margin income statement as follows: